A savings scheme has been launched for expatriates employed by the Government of Dubai, in a first of its kind initiative in the region.

The Executive Council of Dubai, headed by Dubai's Crown Prince His Highness Sheikh Hamdan bin Mohammed bin Rashid Al Maktoum approved the decision.

The move is aimed at enhancing the end-of-service benefits system for Dubai government staff.

Authorities are also studying the possibility of extending the scheme to Dubai's private sector workers on a voluntary basis.

A steering committee, led by the Secretariat General of The Executive Council, will develop an integrated plan for the project.

It includes members from Department of Finance, Dubai Government HR Department, Legal Affairs Department, Supreme Legislation Committee and the DIFC.

Today I approved the ‘Savings Scheme for Foreign Employees in the Govt of Dubai’ at a @TECofDubai meeting. The first of its kind in the region, the Scheme will enhance govt staff’s end-of-service benefits. We are looking at extending the Scheme to private sector employees as well pic.twitter.com/m9O1SKywCn

— Hamdan bin Mohammed (@HamdanMohammed) March 2, 2022

The Savings Scheme has been conceptualised after the Dubai International Financial Centre (DIFC) successfully implemented it for employees working within the DIFC in the year 2020.

The scheme is expected to boost financial liquidity in Dubai in the coming years and enhance the quality of the evolving financial environment in the emirate.

Under the supervision of DIFC, the board of trustees and international investment firms will assume the duties of overseeing the Savings Scheme within a governance system that ensures it serves the employees’ interests first and foremost, provides multiple investment avenues, and supports the planning and management of human resources in Dubai by securing end-of-service benefits for employees on a regular and sustainable basis within a highly efficient integrated system.

The Scheme provides employees with a number of financial benefits, most notably the opportunity to save across different financial portfolios .

It will also protect and manage dues more effectively by depositing them in the scheme starting from the date of enrolment; hence, it will not include any financial dues from former years of service to which the current legislation applies.

Additionally, employees will be able to choose multiple investment structures including traditional investment funds, and others compatible with Islamic Sharia.

Employees who do not wish to invest their benefits will also be provided with options that ensure capital protection.

UAE dispatches search-and-rescue teams, relief aid to Sri Lanka

UAE dispatches search-and-rescue teams, relief aid to Sri Lanka

UAE leaders receive greetings on 54th Eid Al Etihad

UAE leaders receive greetings on 54th Eid Al Etihad

Sharjah Ruler inaugurates Independence Square project

Sharjah Ruler inaugurates Independence Square project

Mansour bin Zayed to lead UAE delegation at 46th GCC Summit

Mansour bin Zayed to lead UAE delegation at 46th GCC Summit

UAE leaders post special social media messages to wish 54th Eid Al Etihad

UAE leaders post special social media messages to wish 54th Eid Al Etihad

UAE President urges youth to drive innovation while honouring national values

UAE President urges youth to drive innovation while honouring national values

H.H. Sheikh Mohammed: Eid Al Etihad reinforces UAE’s values, enduring legacy

H.H. Sheikh Mohammed: Eid Al Etihad reinforces UAE’s values, enduring legacy

UAE to sing national anthem together on December 2

UAE to sing national anthem together on December 2

Ajman earns Guinness record for 603-vehicle Eid Al Etihad message

Ajman earns Guinness record for 603-vehicle Eid Al Etihad message

UAE launches urgent response to Sri Lanka's floods, landslides

UAE launches urgent response to Sri Lanka's floods, landslides

UAE President marks Eid Al Etihad by naming seven mosques after each Emirate

UAE President marks Eid Al Etihad by naming seven mosques after each Emirate

UAE field hospital staff briefs UN delegation on Gaza healthcare support

UAE field hospital staff briefs UN delegation on Gaza healthcare support

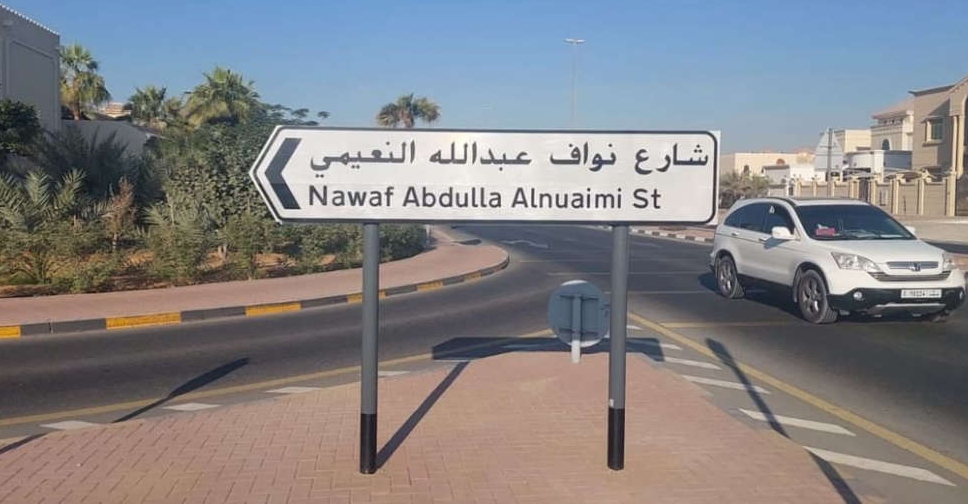

Ajman Ruler directs naming of several streets after UAE martyrs

Ajman Ruler directs naming of several streets after UAE martyrs

UAE President offers condolences to Indonesia after deadly floods, landslides

UAE President offers condolences to Indonesia after deadly floods, landslides

Petrol prices to rise in December

Petrol prices to rise in December

UAE condemns Israeli attacks on Syrian territory

UAE condemns Israeli attacks on Syrian territory

Airbus A320 recall: UAE airlines carry out updates with 'minimal' impact

Airbus A320 recall: UAE airlines carry out updates with 'minimal' impact