Indian Finance Minister Nirmala Sitharaman has announced tax cuts on hundreds of consumer items ranging from soaps to small cars to spur domestic demand in the face of economic headwinds from US tariffs.

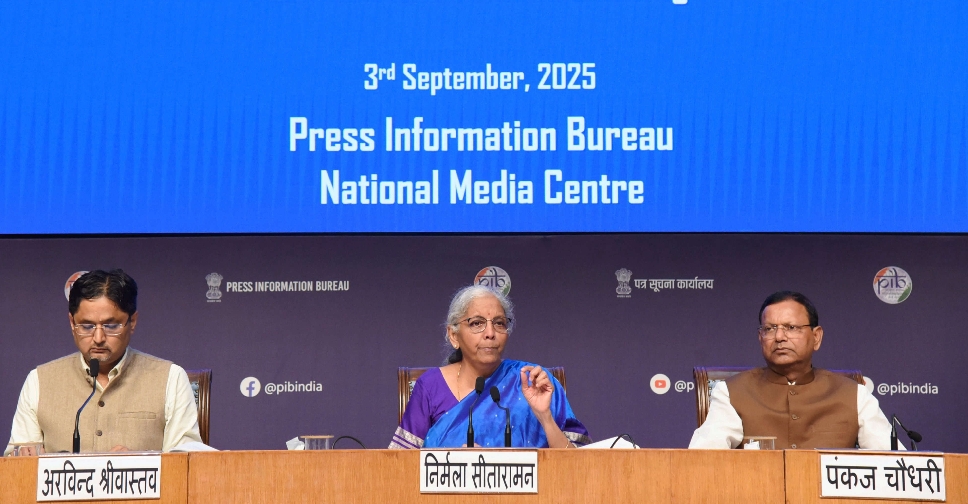

The goods and services tax (GST) panel approved lowering taxes on the so-called common man items and simplifying their structure, Sitharaman, who heads the panel that includes ministers from all states, told a late night press conference.

GST was criticised for its complicated structure and numerous tax categories. To simplify this, the panel approved the two-rate structure of 5 per cent and 18 per cent, instead of four currently that also include tax bands of 12 per cent and 28 per cent.

Sitharaman said the panel approved cuts in consumer items such as toothpaste and shampoo to 5 per cent from 18 per cent, and on small cars, air conditioners, and televisions to 18 per cent from 28 per cent.

She said GST will be exempted on all individual life insurance policies and health insurance.

The panel also approved a higher tax of 40 per cent on "super luxury" and "sin" goods such as cigarettes, cars with engine capacity exceeding 1500 cc, carbonated beverages, the minister said.

The move to reduce the consumption tax was first announced by Prime Minister Narendra Modi in his Independence Day speech to the nation on August 15.

After the cuts were approved on Wednesday, Modi said "the wide ranging reforms will improve lives of our citizens and ensure ease of doing business for all, especially small traders and businesses".

The new rates will come into effect on September 22, the first day of the Hindu festival of Navratri.

Abu Dhabi-India Business Forum to deepen trade, investment ties

Abu Dhabi-India Business Forum to deepen trade, investment ties

GCC tourism and travel hits $247.1 billion in 2024

GCC tourism and travel hits $247.1 billion in 2024

39,546 tourism, hospitality, aviation licences issued up to mid-September: UAE Minister

39,546 tourism, hospitality, aviation licences issued up to mid-September: UAE Minister

Abu Dhabi, Malaysia cooperate on developing next-gen autonomous platforms

Abu Dhabi, Malaysia cooperate on developing next-gen autonomous platforms

Trump signs order declaring TikTok sale ready and values it at $14 billion

Trump signs order declaring TikTok sale ready and values it at $14 billion